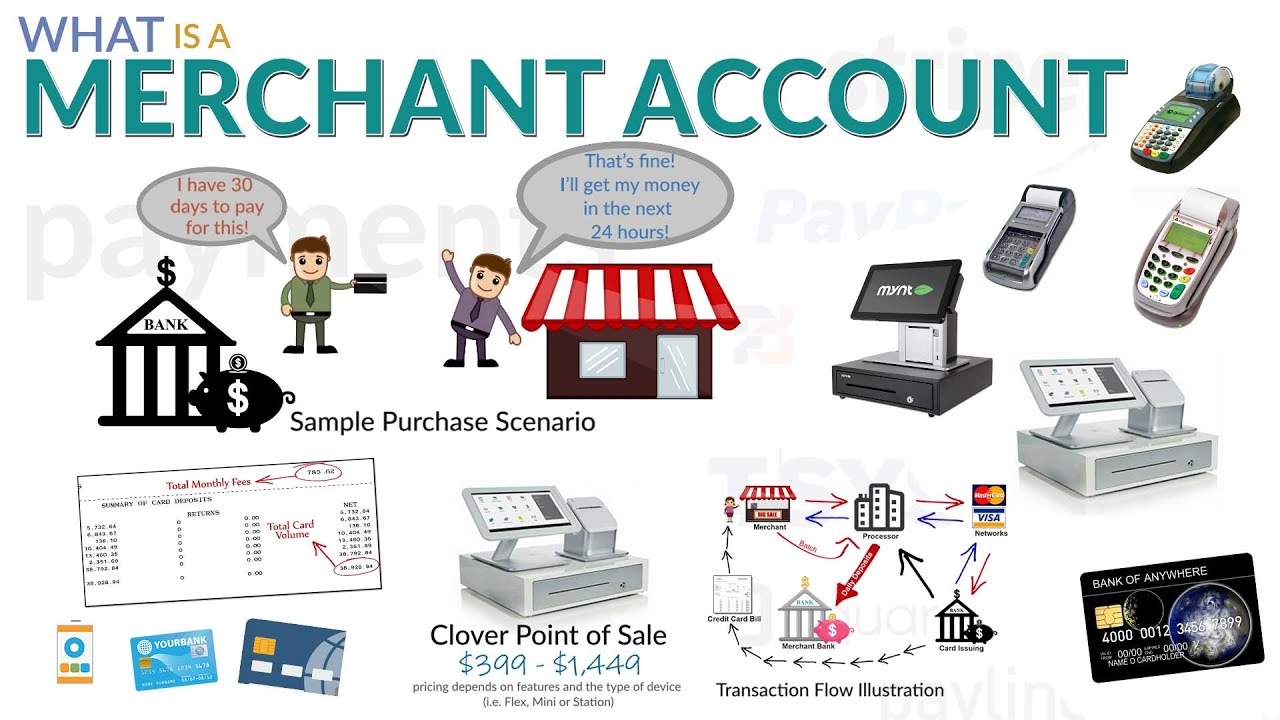

Merchants have a number of options to handle their credit card sales and make the most of other payment processing services. A merchant account is established under a contract in between a merchant accepting credit card transactions and an obtaining bank. Accepting payments via credit cards requires a comprehensive quantity of equipment and software application. For companies who are brand-new in the business of accepting payments through debit card, establishing a merchant account can be a difficulty.

Debit card payments are processed quickly because they are very practical. They are fast ending up being a norm in many company industries. Almost all significant business are now embracing credit card processing for online transactions since it is extremely convenient and fast. For that reason, accepting debit card payments is among the most economical ways of generating income. This suggests that when a business begins accepting debit card payments, it takes a substantial bite out of its spending plan.

Nevertheless, before opening a merchant account, there are a number of things to think about initially. These consist of finding an appropriate credit card processor that will give your small business the best rate of payables each month. Your processor needs to not just process your debit card deals however likewise offer payment gateway services, such as permission and encryption, in addition to transaction processing, cleaning, and conversion for e-commerce transactions. A merchant account supplier that can offer these additional services is a great option.

A merchant account company must, for that reason, be well-established in business. It must have a strong client base and have actually been functional for a minimum of 6 months. The minimum duration of operation for opening a merchant account is 3 years. In order to receive merchant accounts, a company must also be in operation for at least 2 years. While banks and other banks usually require longer durations of operation, they generally do not require as much history. A business that has been processing credit card deals constantly for a minimum of a year is normally an exceptional candidate.

Your processor might only have the ability to procedure debit card payments, which are cashless purchases made with a debit card or a pre-paid visa or master card. Some merchant account providers vary in their ability to procedure debit card payments. Prior to choosing a service provider, it is very important to figure out how your business prepares to increase its present volume of transactions over the next few months and years. If you plan to broaden your company over the next few years, select a merchant account provider that can process both credit and debit card deals. Otherwise, you will have to update your existing account, which is not always an affordable alternative.

Your deal expenses depend on the kind of services you are using. A supplier that processes electronic kinds of payments such as credit and debit card payments requires to charge a cost for its services. Various suppliers charge various rates for this service.

If your company will be accepting debit card payments, select a supplier that charges a lower fee for this service. A service provider that charges more than 50% for debit card deals is unnecessary. You will also require to inquire about what types of fraud security are included with each account. Defense varies amongst suppliers and is very important to your customers. Fraud management consists of fraud detection, fraud alerts, and fraud decrease.

Buyer management includes everyday contact with clients. The function of this service is to assist you comprehend the requirements of your customer and to assist in their Easy Pay Direct complete satisfaction. Various merchant account providers help companies to choose in between an incorporated buyer management system and a standalone solution. An integrated system integrates the components of client management, merchant services and payment processing for a smooth buyer experience. A standalone option allows you to choose aspects that are best for your business.

More Info:

Easy Pay Direct

#240-2006, 2028 East Ben White Boulevard

Austin, Texas 78741